NFTs, also known as non-fungible tokens, are one of today’s most sought-after digital assets. They have become pretty popular all across the globe. Their popularity soared in 2020 when people started accepting and trusting this digital asset.

Its value is increasing with every passing day and has helped people make significant profits financially. However, at the same time, one segment of society thinks this phenomenon has finally reached the tipping point, from where everything will go downwards.

If you are one of those who think that this bubble will burst anytime soon, you need to change this perception. NFTs are now being sold off for millions of dollars. The interest of investors and traders in this asset is enhancing, and there are no signs of it slowing down.

Hence, it’s high time you also invest in NFTs and get your hands on some tokens. However, if you are new to this concept, you must be careful—many scammers in the industry prey on the newbies. To stay safe from them, here is all you need to look for in NFTs.

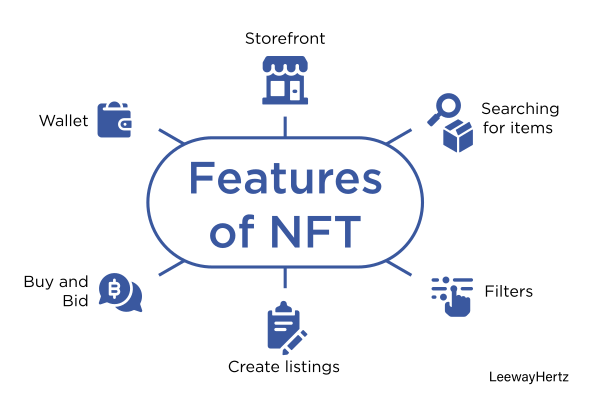

The Features of The NFT

Non-fungible tokens have various features, which you should know before buying them. Most of the time, NFTs come in the form of collections. One of such NFTs is the MekaVerse, which is quite popular amongst traders. Apart from this, Peaceful Groupies and Bored Apr yacht Club offer the buyers individual collections. Each of these individual artworks showcases different kinds of properties and features.

As a general observation, an NFT item that showcases more features has a higher value than others. However, that’s not a rule. Sometimes, a straightforward NFT, but a unique one, has a higher value than a fancy one. One prominent example is that of Bored Ape NFT. Despite being very basic, it is precious.

The first thing you should consider while buying an NFT is its uniqueness. It offers the much-needed worth to the NFT item, enhancing its cost. The rarer the NFT is, the more precious it will be. This is why investors look for NFTs for profit generation and unique ones. They do extensive research to ensure they choose the one that’s the rarest of them all!

An item with the lowest percentage of commonness is what you need to ignore or look over. This way, you would be able to sell it off efficiently. Once you check the properties of the commodity properly, you can ensure its legitimacy.

At the same time, while scrutinizing the commodity, make sure not to become prey to a scam account. Many such accounts showcase counterfeit products as original ones and compel the buyer to pay for them. Mostly, there is no difference in the appearance of the original product and its replica. Hence, ensuring protection from scammers is a MUST!

Verify The Seller

Apart from verifying the authenticity of the NFT item you are about to buy, you also need to ensure that the seller you are getting it from is authentic. A platform where you see the NFTs listed should be accurate.

There are numerous authentic, official sellers of NFTs. These are the platforms that have been able to gain the trust of buyers over the years. One way to verify the seller is by checking their Twitter account. The blue verification tick next to it proves that it is authentic. For instance, there is a tiny blue tick next to the account of OpenSea on Twitter. This showcases that it’s real.

Verifying the buyer before paying for the NFT you have bought will keep you in safe hands. This will ensure that any impersonating account does not dodge you. Rather, buy the commodity from the original seller.

Nonetheless, there are other ways of checking the authenticity of the seller. You can check out the properties of the NFT commodity to analyze whether it is authentic or not. This is important because, sometimes, the seller’s profile is not verified on a social media platform, despite being authentic. This happens when the seller is not very famous or new in the industry.

In this case, even when he is authentic and honest, he may not have a verified social media account. This is when you should consider checking out the product’s properties rather than the social profiles of the seller.

An artist that has good enough followers on his social media accounts is also proof of his authenticity. Check out the followers’ stat and history, and you will instantly know about the originality of the seller.

Cost of Transactions

Now this one is quite important! Just like making banking transactions, you have to pay some fee, and the same goes for crypto or NFT transactions. You need to pay some amount for every transaction to process. Before you decide to buy a particular NFT, know the translation cost and fee you would need to bear.

Just like the e-commerce sites, each platform has its transaction fee. For instance, when you make transactions on OpenSea, it charges you 2.5% of the payment. This percentage of sales goes directly to OpenSea, as a cost of letting you make smooth transactions. This cost is for the sellers only, not the buyers. The latter can make their transactions without having anything deducted.

Nonetheless, that’s not the same for all platforms as each one comes with its working method. For instance, Raible requires the buyers to pay an amount of 2.5% of the total transaction cost. If you hadn’t done enough research, it would have been a shocker.

Hence, it is necessary to read about all the legal terms and conditions before deciding to choose the transactions.

The Liquidity Factor

The liquidity factor of NFTs is also something you should consider. Even though the liquidity ratio of NFTs is very different from that of crypto coins, you still should be well aware of it. In simple words, unlike the common practice with digital currencies, you can liquidate the NFT into your traditional currency. Hence, for anyone who wants to buy NFT for the sake of investment and making a profit, this may be a hurdle.

However, one thing you can do in this regard has fractionalized the NFTs. This means you will divide them into tiny parts, augmenting the liquidity rate. The current market volume of the entire non-fungible industry is crucial for you to consider. Currently, it stands at somewhere around forty billion dollars. However, it can rise or fall anytime, and that too exponentially. The market volume depends upon the type of non-fungible tokens people buy regularly.

One reason behind the low liquidity value of NFTs is that this market is still relatively young. Comprehensive awareness about it is still not there. With little idea that people have about it, the NFT artwork sells for hundreds, not millions.

You need to understand that buying NFT would act as your long-term investment. You can keep it for some time and then sell-off it. Any person who loves it may even be willing to pay much more than what you had initially paid to have it.

Performance of NFT Commodities

While buying an NFT commodity, you need to guess how much it will work in your favor in the future. You need to realize whether it’s a good investment option for you or not. If the particular NFT you have bought enhances its market value with time, you have made a good decision. However, if it remains stagnant or goes lower in value, your choice wasn’t the right one.

Now, how do you determine the future performance of NFT commodities beforehand? The most straightforward manner of that is checking out the account of prospective sellers in great detail. For that, you need to analyze his previous sales and the change in the value of commodities he has already sold.

On the table in his account, you would be able to see the floor price, which is the value range of his commodities. Through the same table, you can see the minimum amount for which his NFTs are being traded.

Final thoughts

NFT has been gaining so much popularity. Many people are now shifting their focus from traditional jobs to services. For e.g., many graphic designers are not learning new techniques to prepare unique NFTs and then sell them on different platforms. This has helped them earn more with less effort. But, from a buyer’s point of view, there are a few factors that one must consider. In this article, we’ve covered the same. We’ve explained all the important factors that one should know before buying an NFT.

Since 2021, the non-fungible tokens industry of crypto has been a much sought-after trend. People looking for new forms of investments find buying cryptos and NFTs enjoyable. If you, too, have been attracted by it, you should give it a shot! However, to be on the safer side, follow the tips mentioned above and tricks of the things you need to look for in NFTs. This way, you will never get dodged by a scammer while buying NFT.