Let’s talk about Non-Fungible Tokens (NFTs). What are Non-Fungible Tokens? How did NFTs get started? Without going into the technology, we will present a general idea of what an NFT is, its use, how the price increases, the future, and more. So, let’s buckle our seatbelts and get ready for the roller coaster called NFTs.

Table of Contents

- What are Non-Fungible Tokens

- How Non-Fungible Tokens Started

- Why Does the Price Change with NFTs?

- Potential Use Cases for NFTs

- Conclusion

What are Non-Fungible Tokens

NFTs mean non-fungible tokens, which are assets that cannot be replicated or copied. Digital art is very similar to traditional paintings like the Mona Lisa, the Last Supper, etc., but they are digital-only. You can buy digital images or art from digital artists and sell them using blockchain technology.

The sale of an NFT does not depict the transfer of an object, but it’s a transfer certificate indicating the ownership of the NFT. The certificate is registered on blockchain technology and is transferred and stored safely using digital wallets. These certificates are unique and cannot be forged or replicated due to their transparent and secure nature.

How Non-Fungible Tokens Started

One of the earliest and most well-known NFTs was CryptoPunks. CryptoPunks has two contracts. The original contract was minted in June 2017 but had a problem and was stolen. The second contract of CryptoPunks was minted later in June 2017. These are the collectible characters that are so well-known today.

Cryptokitties was a game in which people could buy, breed, and buy/sell virtual cats. It was very similar to Pokemon cards but digital. The cats had a unique identity that could not be replicated. One could sell their cats on a secondary marketplace for real money with other players. The uniqueness of a cat made it valuable.

These, along with several other projects, became very popular and are what spawned the beginning of what are Non-Fungible Tokens as we know them today.

Why Does the Price Change with NFTs?

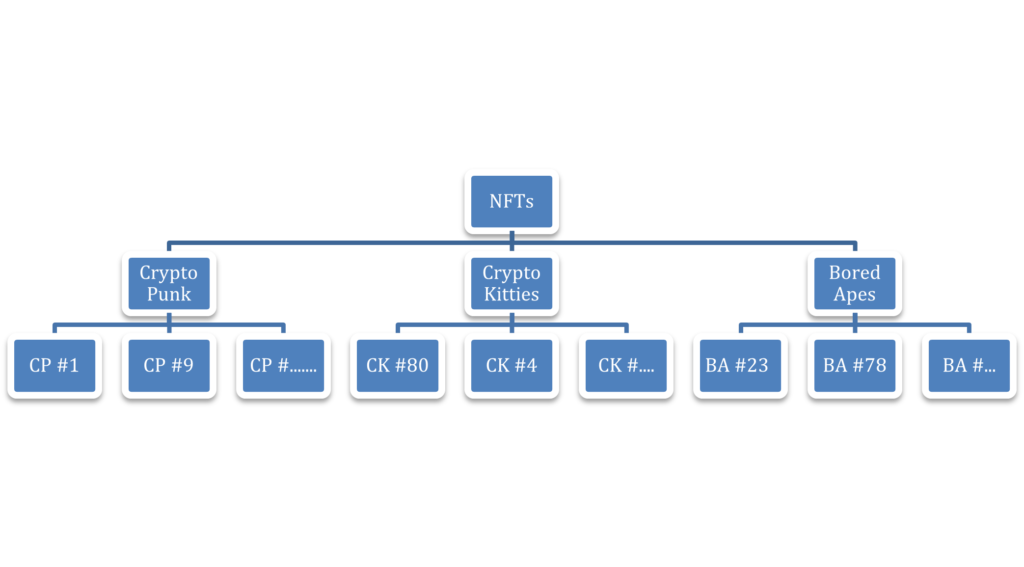

The price of NFT increases with demand, the same as the price of a painting by a famous painter rises with time. It’s the game of supply and demand. This is accomplished by increased awareness and followers. This is also known as the demand side of the equation. There are only limited pieces of an NFT asset (Crypto Punks, Crypto Kitties, Bored Apes).

Each subclass of the investment is unique (CP #1, CK #80, BA #78, etc.), with unique features. This introduces rarity in the overall class or the supply side of the game. Demand increases when there is more awareness of the digital asset and the artist; when the supply stays low, the price increases.

Potential Use Cases for NFTs

Pictures and any digital assets (songs, videos, tweets, digital land) can be sold like an NFT. For example, Jack Dorsey, the founder of Twitter, sold his first tweet as an NFT for about $2.9 million. With the rise of the metaverse and digitalization of the world, NFTs are bound to rise for the foreseeable future.

As a non-fungible token with transparency and security, there are a lot of potential uses in the future. One of them is to use NFTs to track sporting event tickets. This would allow the sports franchise to collect additional revenue if the ticket was resold. This is only the beginning.

NFT owners also sometimes get special privileges. For example, owners of an NFT named Bored Ape Yacht Club to get access to an exclusive Discord server named “the bathroom,” a digital area acting as a graffiti board; you can also get free NFTs from the same stables, which can be resold, and much more.

Conclusion

NFTs are a new piece of technology and will see more and more adoption with the metaverse and digital art emergence. They can be traded using reliable platforms like OpenSea and Solanart. NFTs are very risky, and prices fluctuate wildly since this is an unregulated space.

The price can increase by 90% in a day before losing all its value. You must do proper research before investing and try to avoid any potential scams. Learning what are Non-Fungible Tokens is just the first of many things you need to learn. NFTs are not a one-time money-making scheme. Investing in this asset requires patience and conviction.

This is not just digital art to showcase on your digital device. These valuable assets can be used in the fashion, retail, sports, and real estate industries. NFTs are the new hot topic, and NFTs can expose people to many attractive investment verticals.